Investments

If you feel like you are ready to take some risks financially and potentially increase your assets by investing, then you may want to understand what specific investments are right for you. A stock portfolio should include a mix of investments such as:

- Stocks

- Bonds

- Mutual funds

One of the first steps in diversifying a stock portfolio is asset allocation. This means understanding how your investment dollars can be allocated among varied classes. This type of diversification can attempt to minimize losses and maximize potential gains.

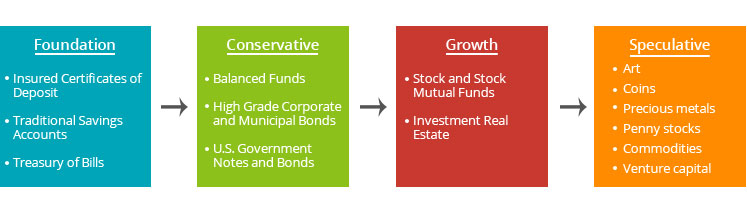

When planning an investment strategy, you should to begin with a strong foundation and build upon this base. Once you have a foundation in your portfolio, you can decide to invest in options that are riskier. The next step in growing your stock portfolio would be investing in options that continue to increase the potential for reward. The final step consists of the most risk which is why it is a good idea to invest in these once your portfolio has a strong foundation. The diagram illustrates investments opportunities from the least riskiest and low rewards to highest risk and highest reward.

Krishnan Company provides a compiled analysis of portfolio management for an investor. The nature and the role of the analysis varies by the different types of active investments. We prepare a portfolio model to analyze trends between various periods, identify deviations and benchmark the portfolio against comparables. This provides a simple snapshot of an investment portfolio and its ranking compared to the industry as well as to similar companies. This type of simple analysis allows clients to make informed judgments about what should or should not be in their portfolios in order to achieve their long term objectives.